When it comes to insurance, saving money is great. Focusing on price versus coverage could leave you underinsured and end up costing you more in the event of a claim. Check out the five most common insurance mistakes and how you prevent them while still saving money.

- Select an insurance company by price and speed

Insurance is too important let speed and price be the most important factor when purchasing a policy. While a speedy quote and a low premium are nice, it doesn’t always mean that you are getting the best coverage or customer service. Choosing a policy on price alone could leave you with coverage gaps that end up costing you in the long run.

A better way to save :Ask friends and family members about their experiences with insurance companies. Select an insurance company that will take the time to write a complete policy, respond to your needs and handle claims fairly and efficiently.

- Insuring your home for real estate value versus the cost to rebuild

Homeowners insurance is meant to cover the cost to rebuild your home in the event of a loss, not on the real estate value of the home. When selecting homeowners coverage, be sure that it covers the cost to rebuild your home and replace its contents – no matter what the real estate market is doing.

A better way to save:Raise your deductible. An increase from $500 to $1,000 could save up to 25 percent on your premium payments.

- Declining flood insurance

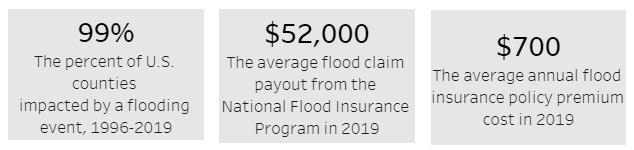

Flood damage is not covered under standard homeowners or renters policies. Considering the statistics below and the fact that 25 percent of all flood losses occur low flood risk areas it’s important to purchase a flood insurance policy. Flood insurance is offered through the National Flood Insurance Program (NFIP) or some private insurance companies.

Source: Historical Flood Costs – https://www.fema.gov/data-visualization/historical-flood-risk-and-costs

A better way to save: When considering a home check with the NFIP to determine if it is located in a flood zone before purchase. If your home is in a flood zone, take steps to mitigate the risk of flood damage.

- Only purchasing minimum liability limits on your auto policy

Purchasing only the minimum limits on your auto policy may provide cost savings but can leave you paying out of pocket later. It also put your financial future in jeopardy should you be sued in an at-fault accident. It is recommended that you purchase a minimum of $100,000 of bodily injury protection per person and $300,000 per accident to ensure that you have adequate coverage in the event of an accident.

A better way to save : Consider removing collision and/or comprehensive on older vehicles that are worth less than $1,000.

- Not purchasing renters insurance

A renters policy covers your possessions and additional living expenses in the event of an insured loss such as a fire or storm damage. The policy also provides liability protection if a guest is injured in your home and files a lawsuit.

A better way to save : Find an insurance carrier that offers mutli-policy discounts. Purchasing multiple policies such as renters, auto and life insurance can lead to reduced insurance premiums.

Source: Five Insurance Mistakes to Avoid and Still Save Money – https://www.iii.org/article/five-insurance-mistakes-avoid-and-still-save-money